Growing demand for mobile payments, by Oxygen 8

The number of British people using their handsets for mobile payments is expected to grow further in 2015, according to recent research results published by Oxygen 8.

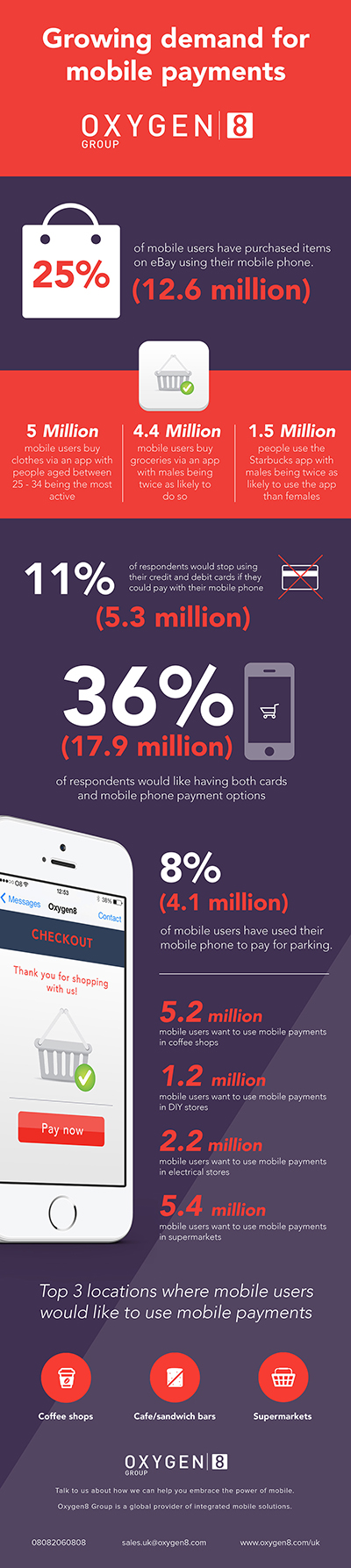

The research shows that over 23 million people (47% of the UK market) want more mobile purchasing options; 11% of the respondents would like to use the mobile phone only for payments, whereas 36% would like to have both credit/debit card and mobile phone payments available. More findings are presented in an infographic published by Oxygen 8, available below.

In connection to this, research we commissioned earlier this year also shows high potential for mobile operator billing transactions to grow to c. £500 million, gaining a 4% UK market share of micropayments for digital goods and services. Being aware and one step ahead of how these changes will impact consumer protection, earlier this year we launched a pilot scheme with Google’s Play Store. The pilot scheme offers consumers extra protection when choosing to pay for digital content (apps, games, music, videos etc.) through their phone bill or pre-pay account.